Maximizing Tax Deductions for Australian Entrepreneurs

Key Takeaways Most ordinary business costs are deductible, but only for the business use portion—private expenses remain non-deductible even if

Key Takeaways Most ordinary business costs are deductible, but only for the business use portion—private expenses remain non-deductible even if

Key Takeaways From 1 July 2026, most employers must pay Superannuation Guarantee (SG) at or near every payday under the

Starting or growing a new business in Australia means understanding your tax obligations, especially the goods and services tax (GST).

The end of the financial year is one of the most important periods for Australian businesses. Occurring on 30 June

Curious about what the 2025 federal budget means for Australian business tax compliance? This article explores the key tax reforms

No business owner enjoys the thought of an ATO audit, but audits are an unavoidable part of Australia’s tax system.

Blockchain technology is transforming accounting in Australia by creating tamper-proof records and improving audit reliability. Its adoption enhances financial transparency,

Mastering business cash flow has become a survival skill for Australian small business owners in 2025. With nearly 80% of

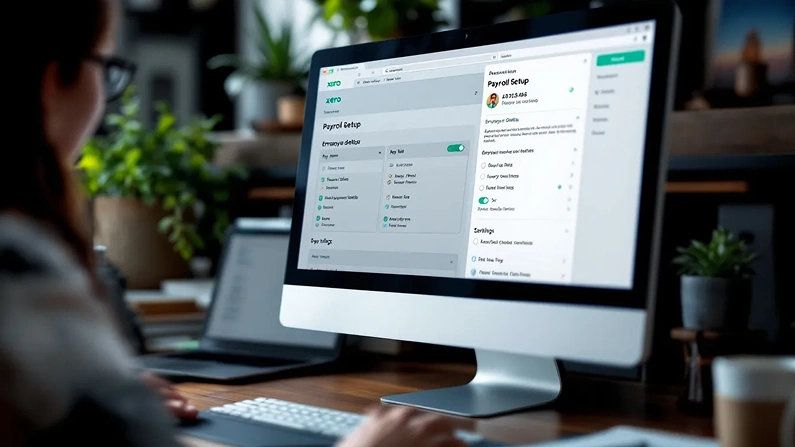

For Aussie startups, sole traders, and small business owners, managing money well from the start is key to thriving. Xero

Key Takeaways What Is Single Touch Payroll Australia (STP)? – Overview of STP as an ATO initiative for real-time payroll